On June 7, 2022, the Center for Drug Evaluation (CDE) of China’s National Medical Products Administration (NMPA) released the Annual Report on Progress of Clinical Trials for New Drug Registration in China (2021).

CDE and NMPA’s annual report represents a comprehensive summary and analysis of clinical drug trials for new drugs within the last 3 years in China based on data collected from drug Clinical Trial Registration and Information Publicity Platform, providing us with valuable insights and big picture data on the status and progress of clinical trials in China.

-

Overview

The Annual Report on Progress of Clinical Trials for New Drug Registration in China (2021) (“the annual report 2021” hereafter) mainly consists of the following chapters:

- An Overview of the Annual Report 2021:

- An increasing total number of registrations

- Drug registration analysis between types of drugs: There are 3 main categories of drugs namely: 1) chemical drugs, 2) biological products, and 3) traditional Chinese medicine (TCM); the former two accounted for the larger share with 54.6% and 40.4% respectively. The drug targets remained relatively centralized within the last 3 year, particularly on PD-1 and PD-L1—which also took a higher proportion in clinical trials. In addition, the indications appeared mostly in oncology related medicines.

- Big Picture Analysis of Clinical Trials in China

- Target Indication and Trial Phases: The top target indication of chemical drugs and biological products was mostly in such areas as oncology and unsurprisingly Covid-19 related vaccines with 20 clinical trials, whereas traditional Chinese medicine concentrated its clinical trials in respiratory, digestive, and cardiovascular indications.

- 2 Types of Clinical Trials and Sponsors: Clinical trials for registered New Drugs and Bioequivalence Tests (BE Test) have gone into different directions—the former upward and the latter downward. The domestic sponsors remained mainstream, accounting for about 80% throughout the last 3 years, leaving the oversea sponsors a steady share of 20%.

- Trends & Issues in New Drug Registration in the Past 3 Years in China

- 4 main issues experienced:

- Homogeneity in registered new drugs

- Inefficient implementation of traditional Chinese medicine

- Insufficient drug clinical trials for special groups

- Imbalanced geographical distribution of clinical trials.

- 4 main issues experienced:

- An Overview of the Annual Report 2021:

-

Highlights

- Clinical Trials for New Drug Application on the Rise

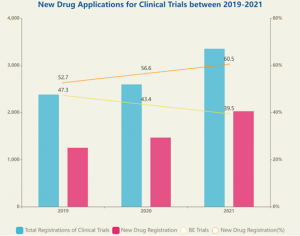

- The total number of clinical trials registered on the Drug Clinical Trial Registration exceeded 3,000 for the first time, a significant increase of 29.1% compared to 2020. The total number in 2019 and 2020 were 2386 and 2602 respectively. Notably, the number of clinical trials for NEW DRUG reached a record year with 2033 applications, a remarkable rise of 38% compared to prior year with 1473 applications, which equals to almost doubling of the number in 2019 with 1257 applications. Meanwhile, the NEW DRUG has been taking up increasing shares of all the registrations for clinical trials, from 52.7% to 60.5% within the 3 years. Accordingly, the proportion of Bioequivalence (BE) Test has seen a consecutive decrease.

- Clinical Trials for New Drug Application on the Rise

-

Growing Trend of MRCT in China

- Multi-regional clinical trials (MRCT) participation in China experienced significant growth year on year throughout the past 3 years. In 2021, the number of MRCTs reached 325, accounting for 9.7% of all the drug clinical trials.

This year-on-year growth of MRCT looks more distinct in New Drug clinical trials. In 2021, 321 MRCTs for new drugs were carried out, amounting to 15.8% of all the new drug clinical trials—a remarkable increase of 54.3% compared with 208 MRCTs in 2020. It is also notable that the number of MRCTs for new drugs conducted in 2020 had risen 21.6% from 171 in 2019.

- Multi-regional clinical trials (MRCT) participation in China experienced significant growth year on year throughout the past 3 years. In 2021, the number of MRCTs reached 325, accounting for 9.7% of all the drug clinical trials.

-

Special Groups

- Clinical Trial Status for Elderly Group in China

- The number of clinical Trials involving the elderly people has slightly increased to almost 75%. This signals an important trend as signs of aging population is becoming more apparent in China, this target segment will be a very important group to consider when designing your clinical trials in China.

-

Year

2020

2021

Total Clinical Trials Involving Elderly Group 1038 1515 Proportion of Total New Drug Trials 70.5% 74.5% Drug Types and Indications of Trials Exclusively for Elderly Group 3 chemical drugs (2 for anti-tumor, 1 for reproductive system diseases) 1 chemical drug (for Parkinson’s disease) 1 biological product (for Adult Endogenic Human Growth Hormone Deficiency) 1 TCM (for mild and moderate Alzheimer’s disease)

- Clinical Trial Status for Pediatric Group in China

- The total clinical trials involving pediatric group have increased from 129 to 168 in 2020 and 2021 respectively. However, as a percentage of total clinical trials, this has reduced from 8.8% to 8.3% in 2020 and 2021 respectively. This could also be influenced by the difficulty of study recruitment and Covid-19 impact. Among all the clinical trials exclusively carried out within pediatric group, biological products (mainly Covid-19 vaccines) were the most trialed type. In the meantime, TCMs focused on respiratory indications while chemical drugs appearing quite dispersive, namely no noticeable trend.

-

Year

2020

2021

Total Clinical Trials Involving Pediatric Group 129 168 Proportion of Total New Drug Trials 8.8% 8.3% Total Clinical Trials Exclusively in Pediatric Group 33 61 Proportion of Total New Drug trials 2.2% 3.0% Drug Types and Indications of Trials Exclusively for Pediatric Group 21 biological products: mainly prophylactic vaccines 8 chemical drugs: anti-infection and skin and ENT drugs 4 TCM: for skin and respiratory indications 41 biological products: mainly prophylactic vaccines 16 chemical drugs: skin and ENT drugs 4 TCM: mainly for respiratory indications Total Clinical Trials Exclusively in Pediatric Group 33 61

- Clinical Trial Status for Elderly Group in China

-

Outlook for Clinical Trials in China

- As the number of clinical trials for new drugs keeps increasing in China—especially the number of Phase-III clinical trials for new drugs, the outlook is very promising in the Chinese market:

- The number of New Drug Application (NDA) will see a constant rise in short to medium term

- The approval processes are being expedited and optimized.

- The Government is encouraging innovative drugs—in particular the “urgently needed” drugs, orphan drugs, and drugs for vulnerable groups such as for elderly and pediatric patients. (Read more: https://www.accestra.com/china-releases-urgently-needed-drugs-list-for-direct-ma-application-fast-track-accelerated-approval/)

- As the number of clinical trials for new drugs keeps increasing in China—especially the number of Phase-III clinical trials for new drugs, the outlook is very promising in the Chinese market: